Scan the QR code to download Dobin!

Mile hacking, credit card stacking, the best card for which merchant or what type of spend… If you’ve come across any of these terms, you’re probably a credit card holder.

These days, it’s more tempting than ever to join the ranks of the credit card savvy, the likes of the MileLion, The Weeblings, and Sethisfy. Once you’ve signed up for a specific card, you’re pretty much in it for the ultimate end goal: whether that is to redeem your hard-earned miles for a business class ticket, cashback that could drastically reduce your expenses, or to be eligible for discounts that would make your budget-conscious parents proud.

So, now that you have your credit cards ready to go, what’s next?

Well, it’s time to optimise your credit card earning potential by acquiring the right tools to achieve your goals. Nowadays, there are plenty of resources available that promise the best-ever strategy for credit card holders.

This isn’t that article.

Here at Dobin, we believe that what you need to boost your credit card experience is a dedicated credit card management tool – one that empowers you to see a summarised and detailed view of all your credit card spend, understand the reward benefits of using the card before each purchase and seeing the key benefits, promotions and top discounts related to your card.

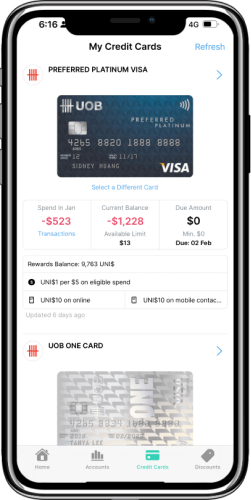

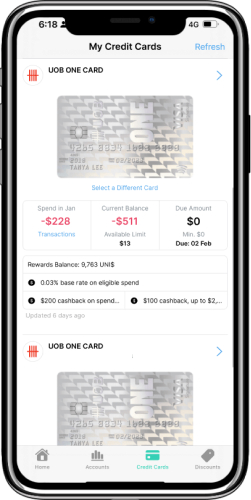

Enter Dobin’s My Cards feature, a solution designed to simplify credit card management.

Here is what you can do with My Cards:

📊 View Spend & Balances: Stay on top of your credit card transactions and balances effortlessly.

⏰ Never Miss a Due Date: Pay your bills on time with a clear view of your payment due date.

🛍️ Exclusive Offers & Deals: Earn more savings with personalised discounts related to your card!

Once you’ve downloaded the app and connected your various credit cards on Dobin, you’re ready to access a higher level of credit card optimisation.

Let’s take a look at how you can manage your credit cards and strategise seamlessly with Dobin.

According to UOB’s FinTech in ASEAN 2021 research , Singapore has the highest credit card penetration in the region. It comes as no surprise that the average Singaporean holds multiple credit cards. However, this could get confusing–fast. Dobin’s My Cards feature not only streamlines relevant credit card information, but it also empowers you with transaction data for each credit card you’ve connected, presented in a user-friendly, all-one-view format to minimise confusion.

The result? A bird’s eye view of your credit card spending, whether it’s with UOB, DBS, AMEX, and more.

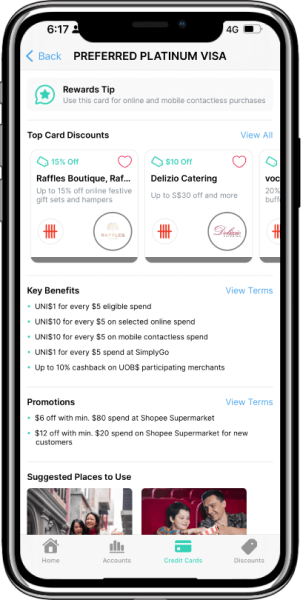

Optimising more rewards per dollar spent is what drives the most fervent credit card holders. While you’re able to look up different strategies or unlock a higher tier with higher spend, this is hard to keep track of if you’re doing this across multiple cards.

Luckily, Dobin’s My Cards does this all for you!

Head to the Credit Cards tab, click on the arrow on the top right-hand corner of each card you’ve added and you’ll find a Rewards Tip that informs you on how to best maximise the rewards from that specific card.

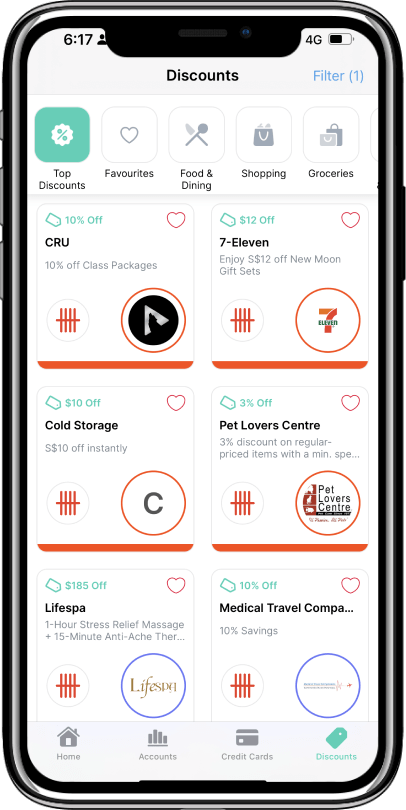

Have you ever bought an item at a store and realised–too late–that you’ve missed out on a massive discount that you were entitled to?

Not to worry, this happens to the best of us. The next time you’re about to say “PayWave” as a payment method for your next purchase, be sure to head to the Discounts tab in your Dobin app and select Filter on the top right-hand side to select the credit card issuer (eg. tap on OCBC for your OCBC credit card). By selecting this option, you can tailor the discounts to your specific credit cards and maximise the relevance of the offers.

Adding this feature to your shopping routine means you can confidently make purchases, knowing that you’ve ticked the box on potential discounts you might have otherwise missed.

There are highs and lows to owning credit cards. While the highs are plenty (think unlocking exclusive benefits, discounts, etc.), the lows would probably be getting unpleasantly surprised with extra fees because you didn’t make your bill payment on time.

Late payment fees on credit cards can rack up, often reaching as high as $100. Using personal finance apps like Dobin to keep track of due dates is a helpful first step. Set up a notification alert a few days before the due date, ensuring that you have enough time to make the payment without incurring any late charges.