Scan the QR code to download Dobin!

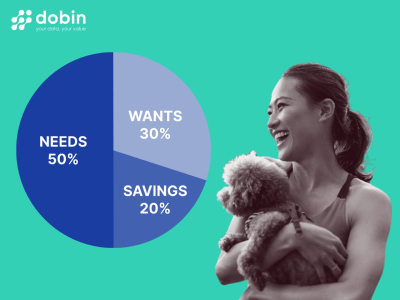

If you’ve been an employed adult for some time now, chances are that you have come across the 50-30-20 rule. That or you’re already living and breathing it, with a well-oiled routine in place whenever your monthly salary hits your bank account.

This routine could involve transferring a portion of your income to a separate savings account to delegating a portion of your salary to pay necessities such as utility bills, rent insurance and groceries. The balance? Well, that’s where you can have a little fun.

After all, life isn't just about growing your savings and paying bills. It’s also about spending quality time with your loved ones, dining out at a new restaurant, and maybe splurging on a Taobao or Lazada spree.

On the other hand, if this is the first time you’ve come across the 50-30-20 rule, let us explore this popular budget concept and explore if it is applicable to Singapore’s higher-than-average cost of living.

These days, the 50-30-20 rule has been on the rise as a viable budgeting technique.

Just as the name suggests, it’s a rule that allocates your income into three main categories:

Needs/Essential Expenses (50%)

Wants (30%)

Savings, Emergency Fund, and Loan Repayment (20%)

Here’s how it could be delegated with an income of $3,000 after CPF.

| Categories | Examples | Income Split | Amount |

|---|---|---|---|

| Necessities | Mortgage/rental, utility bills, telco, food, groceries and transport | 50% | $1,500 |

| Wants | Recurring subscriptions, shopping, travel and self-care expenses | 30% | $900 |

| Savings, Emergency Fund and Loan Repayment | Park money into a savings account/emergency fund, retirement savings, investment product, debt payment | 20% | $600 |

Ideally, as your income grows, your savings should follow suit. For example, if your monthly income goes up from $3,000 to $4,000, your savings should also increase from $600 to $800 based on the rule 20% savings distribution.

After all, you would want to clear your debts as soon as possible so you can allocate more of your income into your savings/emergency fund to build a stronger financial cushion.

While the 50/30/20 rule serves as a helpful guideline, it may require some adjustments to cater to the specific financial challenges faced in the Singapore context.

According to the Worldwide Cost of Living (WCOL) 2022 Survey, Singapore is named the most expensive city in the world –alongside New York City.

With prices of necessities such as monthly water bills and food prices on the rise, this could potentially complicate how much you can realistically put into the respective 50/30/20 buckets.

For example, with current property prices surging, one’s rental payment could easily be ⅓ of the monthly income. Based on the sample income of $3,000, $1,000 would be spent on just rental alone.

With $500 left to spend on other necessities, it doesn’t leave much room to afford a comfortable lifestyle in Singapore.

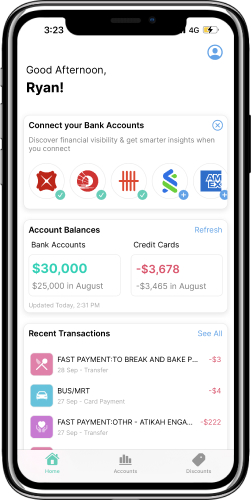

This is where a financial management app (like Dobin)

would help you steer your finances in the right direction. It shows you

exactly how much you’re spending, across all your different bank accounts,

cards, and payment wallets.

Dobin gives you ultimate financial visibility by combining your financial data

into one app and giving you a comprehensive overview of your finances.

The global effects of inflation and rising energy prices resonate across borders. Singapore is no exception. The thriving business hub comes with a unique set of economic challenges that could impact the way households manage their finances to ease the impact of inflation.

Rising water prices : By April 2025, most households will be charged an additional $4 to $9 for their monthly water bill.

GST hike : From 1 January 2023, GST increased from 7% to 8%. There will be a further increase from 8% to 9% from 1 January 2024.

Growing expenses outweigh income growth: According to a 2022 study conducted by DBS , it was found that monthly household expenses for Food, Transportation and Housing has gone up by 13.8% while average earnings have only increased by a mere 2.5%.

Public transportation hike : Due to an annual fare review exercise, bus and train fares are expected to increase by 7%–more than double the previous year’s price hike.

On 28 September 2023, Singapore’s Deputy Prime Minister and Finance Minister Lawrence Wong announced a Cost-of-Living Support Package to provide economic relief for Singaporean households–particularly lower to middle-income families.

The support measures include:

Enhancements to Assurance package: A one-off payment of up to $200 cash for 2.5 million eligible adult Singaporeans

CDC vouchers: Singaporean households to receive $200 CDC vouchers in January 2024

Additional Service & Conservancy Charges Rebate: 950,000 households to receive 0.5 month S&CC rebate in January 2024

U-Save Rebate: From January 2024 to December 2025, households will also receive an additional $20 in rebates on a quarterly basis

Given these growing financial challenges and rising cost of living, how else can we effectively manage our finances?

A good starting point is to determine whether you’re truly on top of your finances. When was the last time you saw your bank account balance? If you have multiple credit cards–how do you ensure that you’re not overspending? Are you aware of your overall cash flow for the month?

The answer to these questions comes with keeping close tabs on your expenses, wherever they happen. These days, we spend in a myriad of different ways, whether it’s via a specific credit card, debit card, and/or digital wallet. While you can always maintain a spreadsheet for this, it can be extremely tedious and time-consuming in the long run.

This is where a finance management app could come in handy to help you understand your finances without the fuss.

Download a finance management app that’s able to do this for you–like Dobin. Then, be sure to start connecting the app with your various bank accounts and credit cards to capture the full picture of your finances.

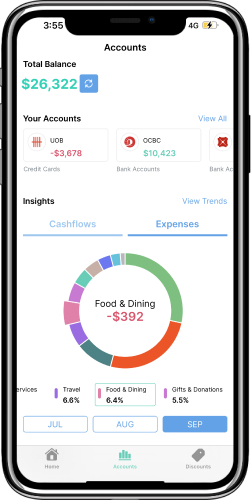

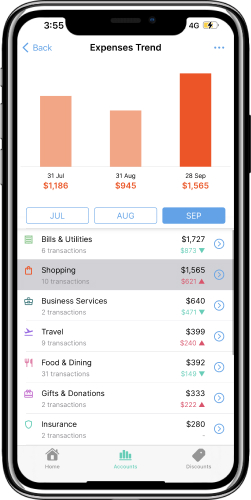

Head to Accounts, then tap on Expenses to see your consolidated expenses chart. Thanks to Dobin’s auto-categorisation feature, it tells you exactly how much you’re spending across a variety of categories, whether it’s Bills & Utilities, Food & Dining, Shopping and more.

Did you know that you can edit your transaction categories on Dobin? Simply tap on a transaction you wish to re-categorise, select “Category” to edit the category, and choose the category you prefer from Dobin’s extensive list.

With Dobin’s Expense Chart feature, it will take seconds to understand which category is your biggest expense for the month. Based on the screenshot, Travel is one of the top spending categories at $1,564.

As Travel is a lifestyle choice and falls squarely under Discretionary Spend, it is one of the categories that we recommend curbing in the subsequent month to funnel more into essential Spend categories the likes of Bills & Utilities, Groceries and Health & Fitness.

Check out this travel guide to find out how you can effectively manage your spend at each stage of your travel journey and stay within budget with the help of your financial companion app, Dobin!

It’s clear that the 50-30-20 rule is a worthy starting point for anyone looking to manage their finances more effectively.

However, the rule should always serve as a guide towards responsible money management and not a concrete financial plan. Ultimately, it depends on individual circumstances–and there’s no one right way to delegate income.

It’s worth noting that flexibility and adaptability are key. You should feel empowered to tailor this rule to align with your specific needs, making necessary adjustments to accommodate housing costs, daily needs, and in the long term, retirement planning.

Ultimately, the goal is to strike a balance between essential expenses, discretionary spending, and saving for a secure financial future.

At Dobin, we understand the importance of improving your financial well-being. That is why our app is designed with features and insights to help you manage your finances better, whether you choose to follow the 50/30/20 rule or tailor a budget that complements your lifestyle.

Ready to get started? Download the Dobin app today.